TurboTax Direct Import – Instructions

TurboTax Direct Document Import Experience

Need your Stash account numbers? Click here.

Great news – if you are using TurboTax to file your taxes this year, TurboTax will allow you to share your Stash account information and directly import your tax documents into TurboTax! No more downloading your tax documentation and manually uploading them. You will need your Stash account number for each account that you have with us.

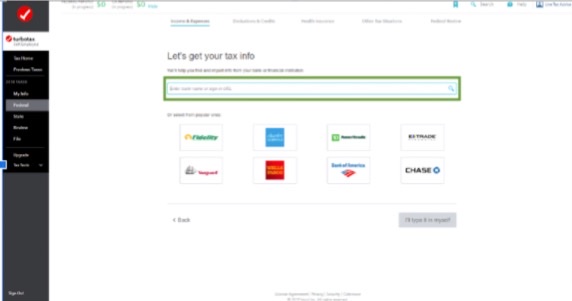

- During the Income & Expenses portion of the TurboTax filing process, you will be prompted to import info from your bank or financial institution. Type “Stash” into the search bar.

- Select “Stash” from the search results.

- Use your 8-digit account number and the Social Security Number associated with the account to enable direct document import.

Note: You can click the Click Here link (shown in the screenshot below) for help finding your account number; or you can follow the steps here.

- Using those credentials, TurboTax will list your 1099 form from Stash. Click Import Now.

- Click Edit/Add to import additional tax forms, if necessary (repeat steps 3 and 4 for each additional account).

Important: Only enter account numbers for Stash accounts with 2024 tax documents listed.

If you have any questions on if you should be seeing any docs please see here.

- TurboTax will flag any forms that need to be reviewed.

If the customer has any questions during this process, TurboTax offers two resources:

- Search function (top-right of website) – A customer can enter a form name, and TurboTax will direct the customer to the appropriate screen for that form.

- Live Tax Advice (top-right of website) – Customers can get live tax advice. (Note: This does require a TurboTax upgrade)

Here’s how you can find your Stash account number during TurboTax’s Direct Document Import

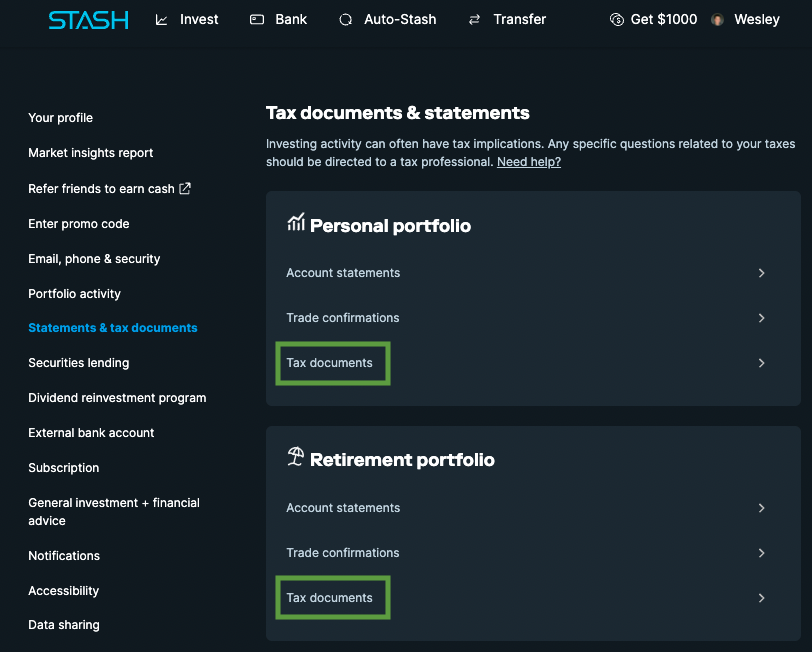

On the web:

- Click here, then login to your Stash account.

- Click Tax Documents for each Stash account.

Important: Only enter account numbers for Stash accounts with 2024 tax documents listed.

If you have any questions on if you should be seeing any docs please see here.

3. Your 8-digit account number can be found at the top-center of your Stash account statement.

On the app:

- Click the profile icon (iOS) or hamburger icon (Android) in the upper-left corner.

- Scroll down to the Documents section and click Portfolio.

3. Click Tax documents for each Stash account.

Important: Only enter account numbers for Stash accounts with 2024 tax documents listed.

If you have any questions on if you should be seeing any docs please see here.

4. Your 8-digit account number can be found at the top-center of your Stash account statement.

DISCLOSURES

This information is subject to change and should not be considered legal or tax advice. Stash does not provide legal or tax advice. If you have questions regarding your personal circumstances, you should consult a tax or legal professional.

Stash is a paid partner of Intuit Turbo Tax

Stash may receive compensation from business partners in connection with certain promotions in which Stash refers clients to such partners for the purchase of non-investment consumer products or services. This type of marketing partnership gives Stash an incentive to refer clients to business partners instead of to businesses that are not partners of Stash. This conflict of interest affects the ability of Stash to provide clients with unbiased, objective promotions concerning the products and services of its business partners. This could mean that the products and/or services of other businesses, that do not compensate Stash, may be more appropriate for a client than the products and/or services of Stash’s business partners. Clients are, however, not required to purchase the products and services Stash promotes.

Related questions View all Tax Information

Didn’t find your question?

Tell us what you’re looking for, and we’ll search for resources that could help.

Ask your question